Welcome to Team Jackie Porter!

As a Certified Financial Planner and Canada's financial confidante with various awards, I and my team aim to help you understand your finances, plan for the future of your dreams and build your wealth.I am an award-winning Certified Financial Planner in Canada serving thousands of professionals, established businesses and families with 24 years of experience. My practice focuses on cash flow management and tax planning strategies for small to medium-sized businesses who need someone at the table working on their behalf. In addition to serving business owners, I and my team help professionals who haven’t done proper financial planning to set and achieve their financial goals as they near retirement. Besides financial advising, I am a featured speaker and advocate for numerous corporate, professional and charitable organizations.

WHO WE HELP

How is my team different?

We know that people are intimidated by the technicality and formality of the financial services industry and how it doesn’t speak to everyone’s real financial problems.

We overcome this issue by differentiating our approach to finance. Our services focus on our community’s real financial challenges in a sincere, fun and simple way. By easing the understanding of the finance world, we envision creating a community that feels inspired to improve its financial literacy and encouraged to build its wealth.

HOW DO WE BUILD YOUR WEALTH?

As a team of Certified Financial Planner and advisors, we build your wealth by helping you to clearly see your financial circumstances and working with your “team of advisors” to create a “360” degree snapshot of your current and future financial circumstances. To help you get started on your journey, we offer you a complimentary 30 minute consultation session.

Want to start your financial journey? Book your complimentary 30 minute consultation here!

Jackie's 360° Endorsements

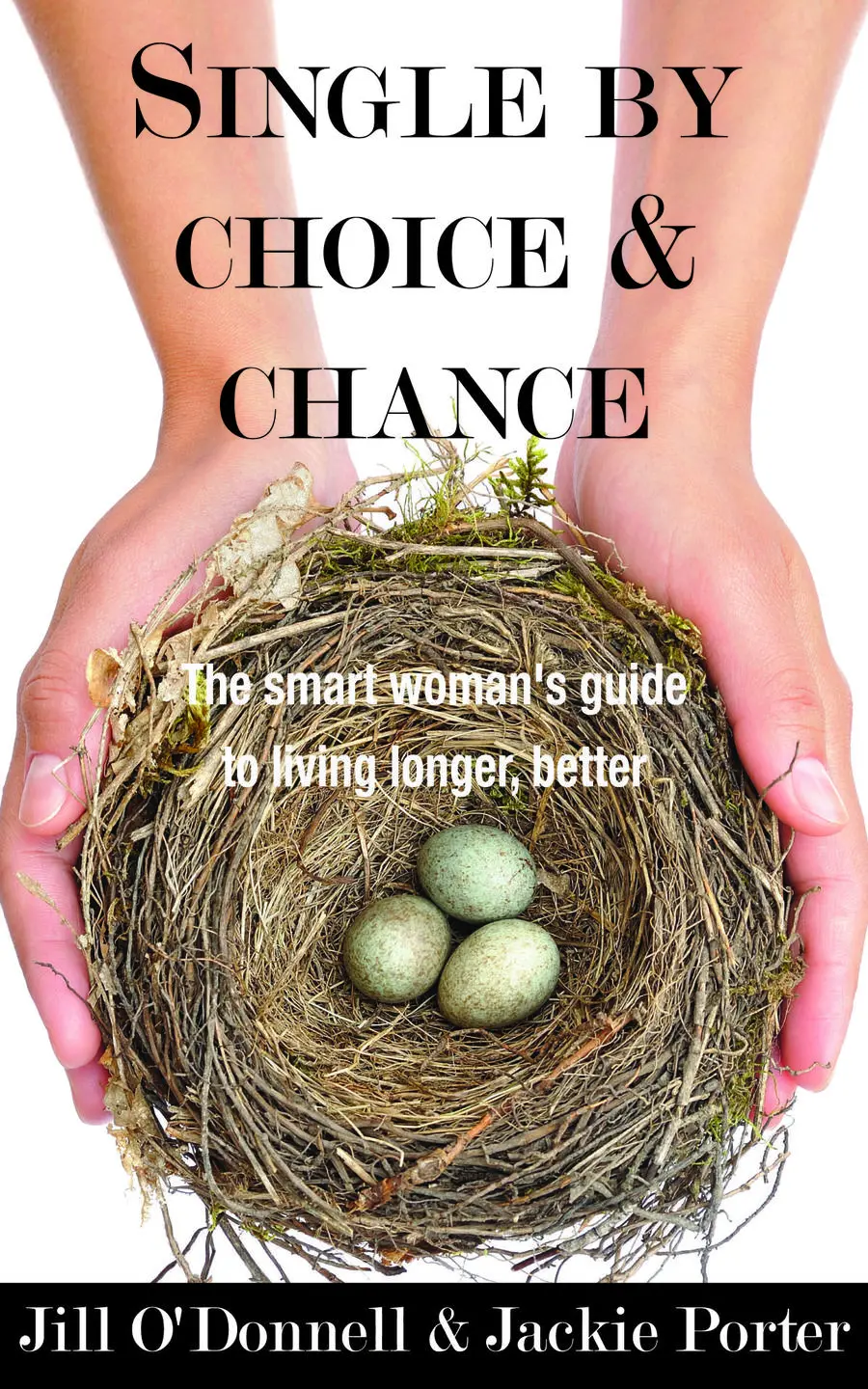

SINGLE BY CHOICE OR CHANCE… The smart woman’s guide to living longer, better.

Co-authors: Jackie Porter and Jill O’Donnell

143-pages soft-cover

If you are over 45, single by choice or chance, living in Canada today and are examining the options for your future, this book is for you. The path you take depends on your preparedness from where you will live to how best to cope with aging parents and how you will address your own financial future. This book will assist you in designing a life plan that encompasses not only financial goals but also your other life priorities- such as your career, relationships, and other personal goals.

Order your copy (or a copy for someone you know) and find your own path to a happy, healthy, and financially stable and longer life.